It’s time for our monthly spending update and quarterly net worth update! Spoiler alert: the net worth update is much prettier than the spending report. We prepared this update at the beginning of May, but are just now getting around to posting it.

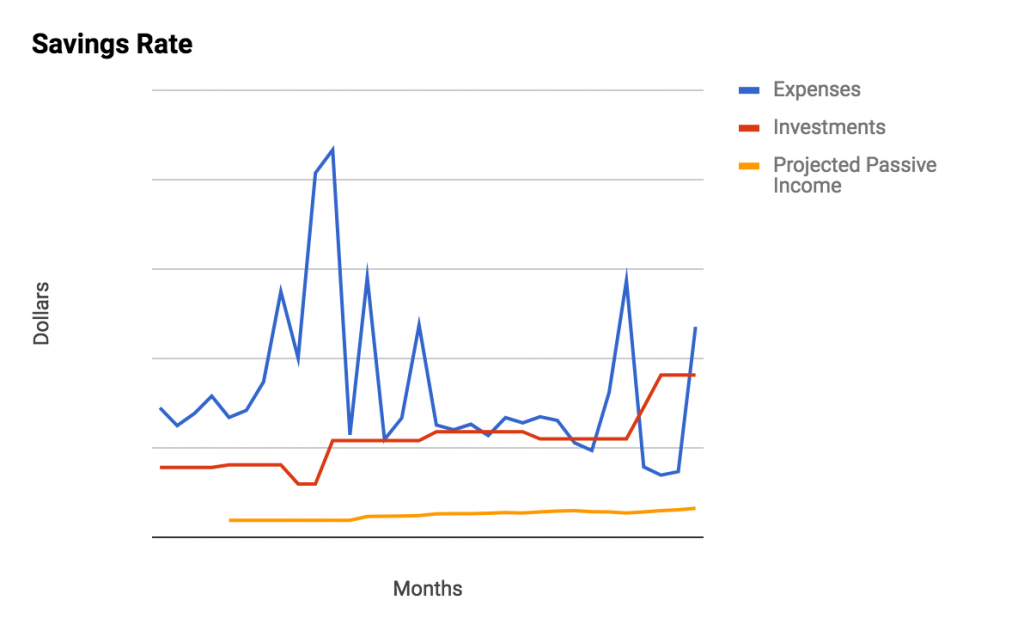

We had a doozy of a month in April. It was pure chaos. And it shows in our spending–mostly due to a few large expenditures. Our Federal tax bill was an involuntary expense, but also anticipated. Taxes accounted for over half of the spike. The other half was voluntary–we splurged on an expensive item at a charity auction. A good friend is on the committee and it’s a cause we support, so we don’t regret it. Still, some restraint or at least more forethought, would be wise in the future. We can get more generous once we have locked up financial independence.

Both of us suffered from a severe cold early in the month. That set things off on the wrong foot. We never quite recovered from the upheaval, even as our health improved fairly quickly. Meal planning, cooking, and packed lunches never went smoothly for the month. Ms. Vine broke her running streak and struggled to find a consistent workout routine. The weather was about as wild as our spending–with some days sunny and beautiful, some days snowy, and some days rainy. Like we said, April was rough. It’s so interesting how an organized financial life tends to match an organized everyday life. In any event, this spending spike is still lower than either of our two highest spend months in 2018. We plan to make this an anomaly that doesn’t occur again.

Beginning in May, we are moving to a traditional zero budget. The goal is to finally rein in these overspending months. We have initiated a more disciplined approach to the day to day. And a few tweaks are necessary if we’re going to pay off our mortgage early and hit our financial independence timeline. If the zero budget works for us, we may be able to shave a year or more from our careers. The thought of retiring in four years (or less!) instead of five is a little scary. That’s why we have to earn it and why we continually review and refine our target numbers (in terms of spending and saving).

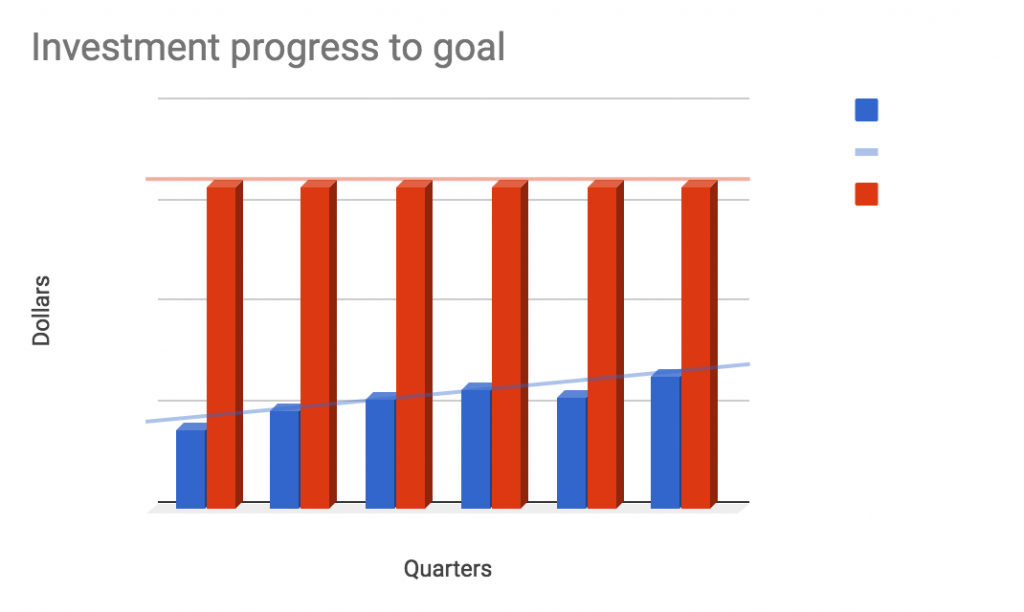

On the net worth front, we crossed 40% to our original nest egg goal. Net worth hit an all time high at the end of April. Since we set that original nest egg goal, we’ve adopted a two-phase approach to saving, which has reduced to the nest egg total we’ll need at the time we decide to pull the plug. This is thanks to the power of compounding, and how our Phase II funds will grow, untouched for several years before traditional retirement begins–it’s not because we have changed what we’ll expect to need. But for simplicity and consistency, I’m keeping original nest egg target on the chart as is. As of April 30, we’ve saved 36% of our Phase I goal and 73% of our Phase II goal. It is so exciting to see these numbers climb! Depending on market performance, sometime in 2019 we might double our net worth from where it was in August 2017 when we started regularly tracking it.

Here’s how we did on our April goals:

- Get back on track with production target (career job goal)

- F – If anything, I am now further behind. Both of us had a tough month at our career jobs

- Minimalism game

- F – We did some organization in one of our storage rooms, but did not officially play the minimalism game.

- Weekly blog posts

- A – This happened thanks to scheduled posts! We try to write two posts every weekend so that we can be ahead of our desired schedule.

- Personal spending within budget

- B- We were relatively close, but slightly over. Proper budgeting of this category will be critical under the new zero budget.

In May, we want to accomplish these goals:

- Meet our new budget

- Weekly blog posts

- Complete two half marathon races (Ms. Vine)

- Resolve credit card balances

Here are the monthly and quarterly charts for April.