This month has been full of summer fun. To free up the weekends, we’re working extra hard Monday through Friday. It’s tiring. We’re worn out. Our budget is also a bit busted from all of that summer fun, too.

This exhaustion has us thinking about whether we’re making the right choices. We are balancing a life we love against planning for a future where we no longer need to trade our time for money. But most of the time, this feels like burning the candle at both ends instead of achieving balance. We recently considered whether it makes sense to slow down on the financial independence effort. What if we both switched to part-time, or otherwise less stressful, jobs and reduced our incomes, but continued to work longer? For now, we decided to keep up the intensity. We’re so close. And there’s no guarantee about tomorrow. Something could happen that forces us to slow down before we’re ready. Preparing now means we’ll be in a better situation in case of the unexpected.

We took a couple of short road trips in July. The windshield time gave us the opportunity to talk about how fast the years fly by. It’s been eight years this month since I changed careers to go to grad school. I left my former position about three weeks before grad school would begin. This summer I’m recalling those wonderful weeks without wake up calls or external deadlines. That’s what we’re looking forward to. It’s hard to believe that was almost a decade ago. But memory is funny that way. There were plenty of moments during those years when it felt like grad school would never end.

Right now, I can relate to those feelings of “will we ever get there?” Living life on the way to financial independence doesn’t have as many obvious milestones as a grad school program. Each completed semester and class brought me one step closer. But we know that if we keep doing the right things, and keep pressing on, the years will pass, our net worth will grow. It’s happening already. Every month when I check our balances against our projections, we’re right on track. About four years from now, I’ll probably write in disbelief that we’ve reached our target nest egg numbers. We just make our own milestones–even if the market isn’t as reliably predictable as an academic calendar. That’s why our milestones include a mix of things we can’t control, like net worth and things we can, like spending. In turn, this is a major reason we are preparing to pay off our mortgage early as part of our plan.

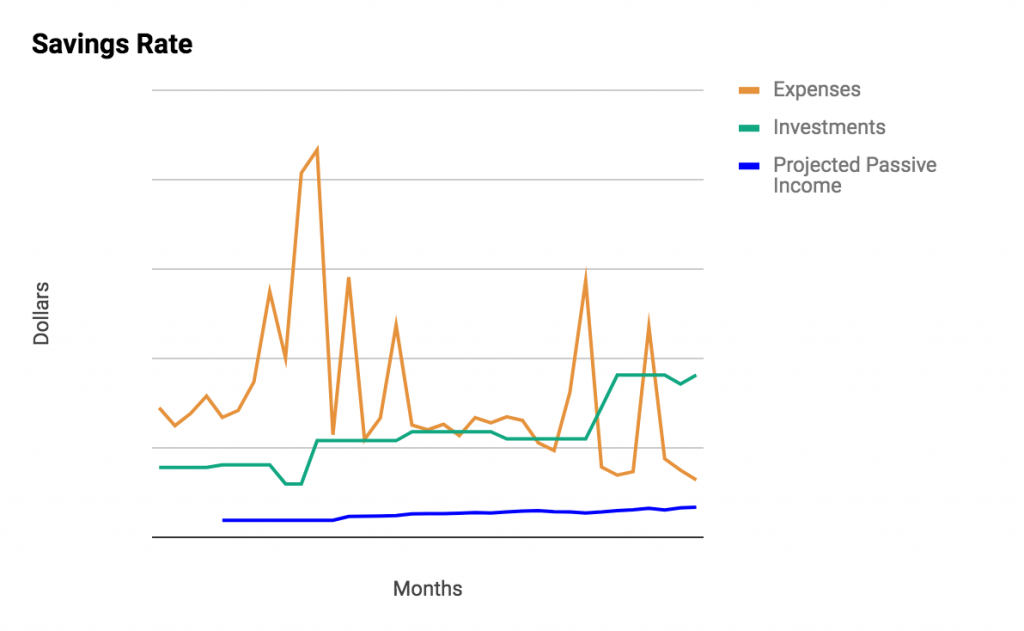

Speaking of the market, July was a bummer of a month. The volatile market over the last year has been…something. We are close to breaking another $100,000 milestone and it’s frustrating when the market doesn’t give us a boost. As a result, this update is much more about what we’re doing than what our money is doing. Here is a look at our chart from July.

July goal check-in

July was not a great month for goal achievement. But, we’ve been soaking up as much summer as possible. So maybe I just didn’t set the right goals!

- Write a journal entry – F

- This should have been such an easy task. Anyway, I need to get back into a regular journaling routine somehow!

- Cross one item off the 101 tasks list –done

- Dentist visits — had my second visit this year. This was one of those poorly drafted goals, but the purpose was to get back on track with regular dentist visits. That’s happened, so I’m calling this one complete.

- Declutter the garage – F

- Sacrificed on the altar of “summer fun”

- Make one estimated tax payment – F

- This did not happen, thanks to a property tax bill. Fortunately we can make estimated tax payments anytime in 2019, so this will go back on the list in a future month.

- Catch up on dairy share usage –B-

- Used up all but one partial half gallon, but paneer didn’t set and neither did the yogurt so most of the backstock went to waste. What a bummer! I have, however, kept up on consuming the weekly share. Two half gallons remain in the freezer.

August goal setting

Ahh, the dog days of summer. What should we accomplish in August? Let’s see if we can do any better this month.

- Write a journal entry

- Weekly blog posts (I’m reinstating this goal because I almost missed it in July).

- Stick to restaurant budget

- 100 Mile running month

- Cross one item off the 101 tasks list

- Catch up on dairy share usage