The first half of October whizzed by before we even knew what happened. We had more social activities planned than ever it seemed. For some reason, October always seems like an exceptionally busy month for us. We had a football tailgate–this one that we planned. Like camping, tailgating is a lot more work when you’re the organizer. We didn’t even last through the first quarter of that game on account of the weather. Our team lost, too. Cue the sad trombone.

We took a road trip with a group of friends to an amusement park. All in, that weekend of fun cost us about $1,000. Weekend getaways always seem to tally up in that range. We had a blast, though, and the time with friends was priceless. The key is to avoid spending $1,000 every weekend. It’s funny that our holiday week vacation might cost the same as this one weekend. That’s largely thanks to “prepaying” for our lodging through use of our timeshare. We saved ourselves some money on amusement park food by packing a lot of things, including a crock pot stew that was ready when we took a lunch break. Lunch in the park would have cost around $20 per person (multiplied by seven of us for a total of ~$150). As important as the money savings, though, it was nice to have a hot meal waiting and to socialize in the quiet, comfortable warmth of our hotel room.

Both Mr. Vine and I did a little bit of job searching in the interest of increasing our income. I also focused on improving my daily productivity at the office in an effort to become bonus eligible and increase my chance at a pay raise. I am underpaid by around 20%, so it’s fairly realistic that I could make a move and capture that increase.

Our nephew came up for a long weekend visit. We considered taking him on an adventure somewhere, but in the end scrapped the pricey weekend getaway idea in favor of doing things around our city. Not having kids of our own, it is important for us to teach our nephews the life lessons we’ve learned. Our lifestyle and personal finance philosophy is quite different from their parents. Even though we aren’t going to be the top influence in their lives, we want to make sure they know there are many ways to approach their futures as adults. While jetting off to New York City for a weekend has certainly been a part of our lifestyle, we wanted to show our nephew that you can have a great time spending very little and exploring your own neighborhood.

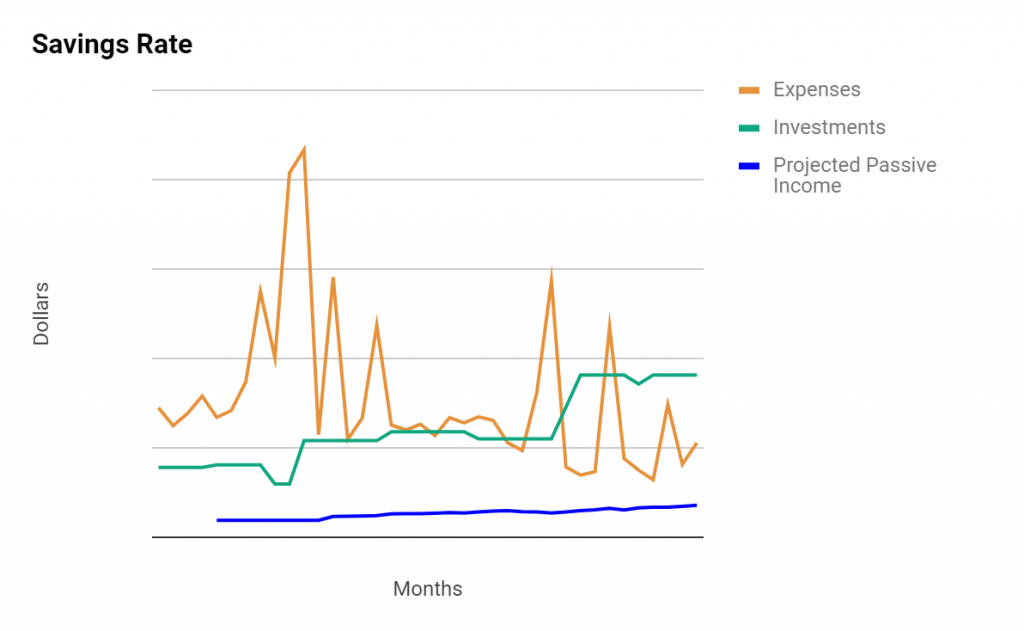

Spending was on the higher side for October. Both Mr. Vine and I had some work expenses that increased our personal spending. All of that is reimbursable, but it I don’t track our income on this chart, only expenses. We also paid our farmer for a bulk pork order. And our semi-annual auto insurance premiums came due as well. Here’s a look at the chart:

The second half of the month seemed to drag on, in part thanks to an unusually heavy workload for me. My health and fitness plans were a disaster in October. I’ve been working on making small, incremental changes every day with the goal of losing about 1 lb per month (with a total goal of just 10 lbs). It feels like I’m making a daily effort to either cut back on calories or add exercise, but I’m not seeing or feeling any results. So I’ve concluded that maybe I’m not being honest with myself. In November, I’d like to add one or two concrete actions, like tracking water or food intake, making a weekly meal plan, or getting back to a daily run streak. On the other hand, though, I appreciate that there are limits to what I can do. Sometimes my career job swallows my life. But that’s why we’re here–to make that a temporary condition.

How we did on October goals:

- Daily exercise

- F – This was a massive fail.

- Stick to restaurant budget

- C+ – We were oh so close (just a few cents over) and then a friend gave us a last minute invitation to meet up on the last weekend of the month, which put us over.

- Cross one item off the 101 tasks list

- F – We had good intentions to do one of these items while our nephew was here, but it didn’t happen.

- Take at least 3 actions to get a pay raise

- A – Both Mr. Vine and I did this. I followed up on a couple of job leads and advanced a few things, so we accomplished. But Mr. Vine came through with an unexpected new job offer for a 10% pay increase!

November goals:

- Make one estimated income tax payment

- Weekly blog posts

- Daily exercise

- Cross one item off the 101 tasks list

One Comment