Happy new year! Only a couple of months late. This month we debuted a new budget and took a big international trip. That was fun. We traveled to Asia with a group of friends. It was exciting and challenging and wonderful. We also visited a new to us country — check out our updated map! I’ll recap that trip in more detail in a future post.

For now, we’re talking about our how our finances looked in January. Spoiler alert: much better than December. That came as a big relief because we still had some big expenses in January–like portions of the trip that weren’t prepaid and some big personal expenditures (e.g. new clothes for the trip) that I made. Other than the trip, which merits its own post, January was fairly uneventful. That’s often helpful towards making good progress on our financial goals.

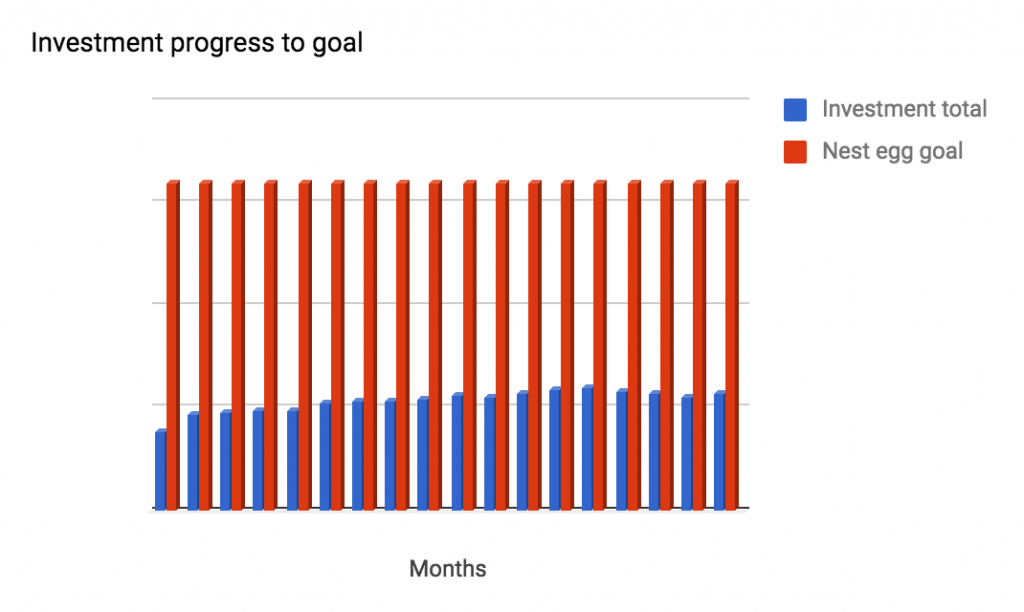

The new budget for 2019 calls for elimination of the car loan (done!) and sizable reductions in travel and restaurant spending. These reductions will allow us to make a big increase to our monthly investment contributions. We expect those increases to firm up our financial independence day to approximately six years from now. We’re hoping to close out 2024 at or above our financial independence number. You can track our progress along the way through the graphs and charts we post each month.

We didn’t set many lofty goals for January, but let’s see how we did.

- Publish one blog post in addition to monthly update — F! January is undistinguished as the first month to go without even one post.

- Start a run streak for 2019, which means running at least one mile everyday in January (Ms. Vine) – B. I made it all the way until the day we took a very long flight to Asia. I was supposed to run during our long layover in Tokyo and that’s how the streak ended

- Complete one item from 101 things list A – This is a goal I like putting on repeat. We visited a new country.

- Total spending within budget – B+ We were just over, but so close.

Here are our February goals.

- Publish one blog post in addition to monthly update

- Resume running streak (how about a lunar year streak for the Year of the Pig?)

- Complete one item from the 101 things list

- Total spending within budget

- Increase our monthly investment amount

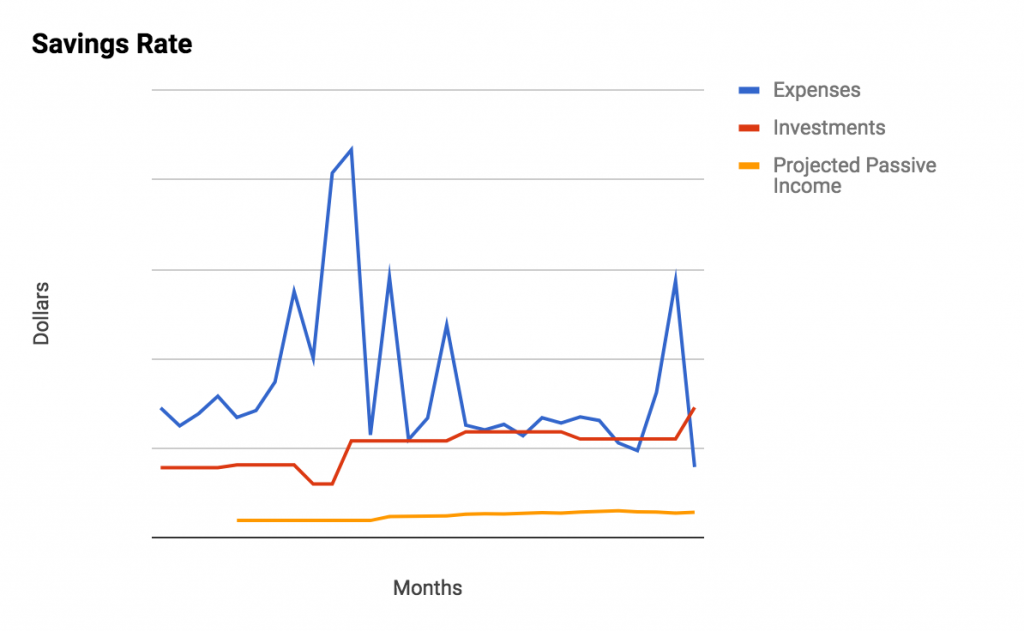

Our charts look very different this month. Check out that gap between the expenses and investments line! We definitely want to see that continue throughout 2019. The progress to goal chart is a little discouraging–the progress looks so small when view monthly (and often we go backwards due to market fluctuations). Maybe I should start posting that one quarterly, or annually? Let me know if you enjoy seeing this on a monthly basis and whether I should keep that up.

One Comment