Apologies for the delay in posting this! January was the first month where I didn’t manage a single post, not even the monthly update. Of course we continued to track our spending and investment progress, but the holidays, a couple of trips, a pet health issue, and my new job (with its attendant lack of free time) conspired against us. Things continue to settle down, in a good way, so moving forward I’d like to commit to at least one monthly post in addition to the update (for a total of two posts minimum per month).

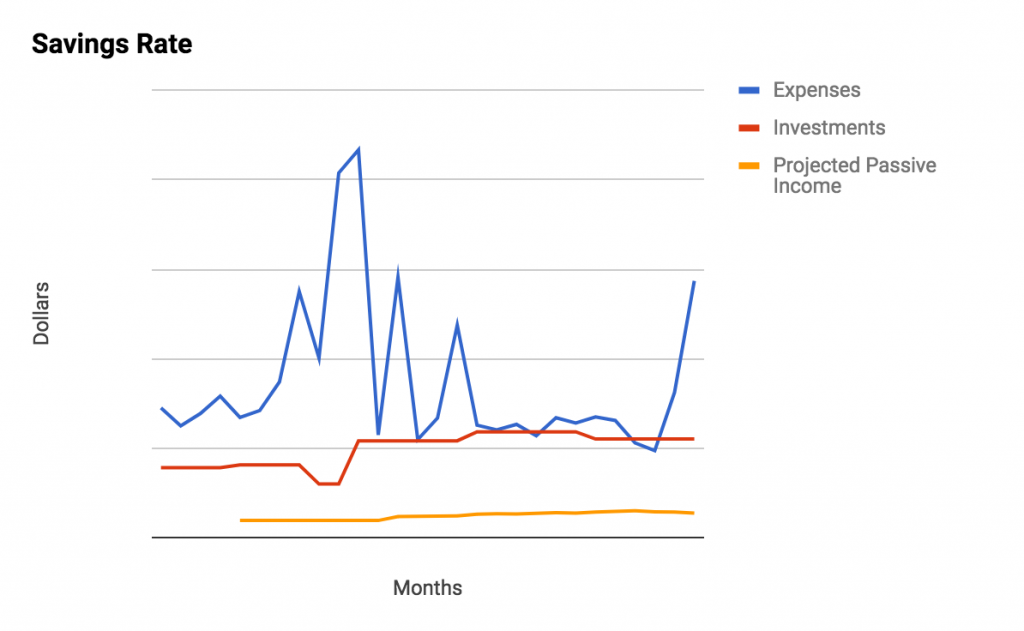

As predicted, December was our highest spend month of 2018. The high spending is attributable to a few causes: regular year-end expenses (e.g. timeshare dues); travel (e.g. we took a vacation to Florida over Christmas week); pets (as mentioned above, one of our cats was diagnosed with hyperthyroidism and we chose an expensive treatment option with a good prognosis); and finally, a few luxury splurges (e.g. the balance on new blinds for our apartment). Of all these expenses, the treatment for our beloved senior kitty was the one I most appreciate. Because I’m writing this update so late, I can say she’s had a wonderful outcome. Buying more good time with a 16 year old cat that has been a part of our lives for all of hers is so worth it to us. We have no regrets about the other expenditures, although Mr. Vine is on a mission to pull down restaurant spending on trips during 2019. Considering the amount by which we reduced total annual spending in 2018 vs. 2017, I can live with a couple of high months–as long as these crazy spending months are true outliers. I will post an annual review for 2018 that will discuss this reduction in more detail.

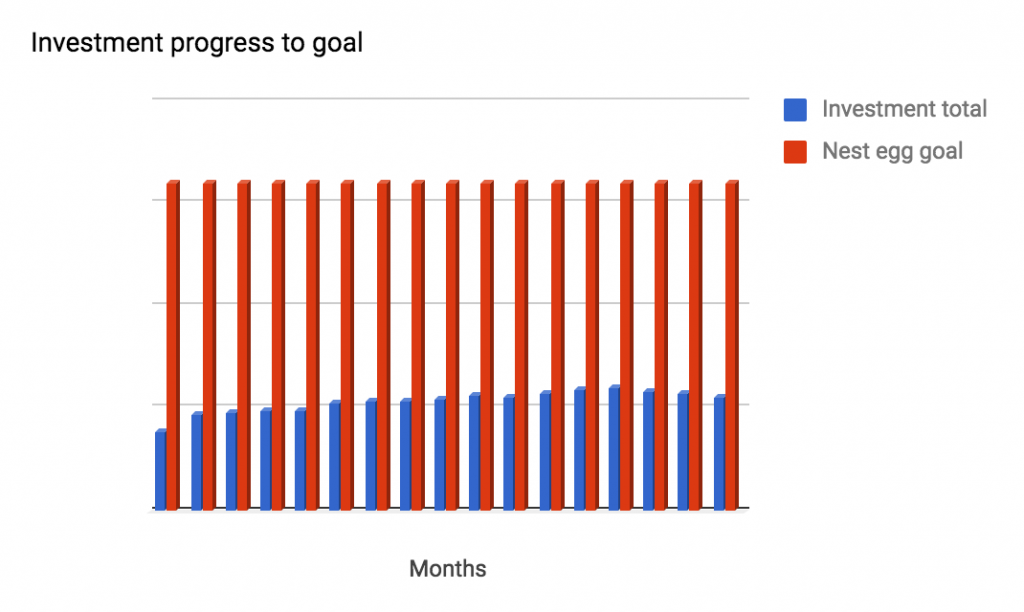

Our high spending month corresponded with a terrible month in the markets. As a result, our net worth plummeted and our graph looks quite gnarly. We ended the year feeling like we didn’t make much progress at all towards financial independence. These are the times when we appreciate having a financial advisor. It helps us stay the course when it feels like we’re just treading water to have a coach of sorts. And then there’s the accountability factor–we’d be mortified to call up our advisor and ask them to liquidate our brokerage account so we could buy a boat. When it’s only the two of us, we can talk ourselves into all sorts of bad ideas. For those of you who are more disciplined, congratulations!

So, let’s see how we did on December goals.

- Publish one blog post in addition to monthly update F! We’ve already talked about how this was a giant fail.

- Daily exercise (we’re reviving this one now that my foot is sufficiently healed) C for reality, but A for intention.

- Restaurant and grocery spend within budget F! Both of these categories were really high.

- Complete one item from 101 things list A — we sent the last payment in for our car loan!

Here are our goals for January:

- Publish one blog post in addition to monthly update

- Start a run streak for 2019, which means running at least one mile everyday in January (Ms. Vine)

- Complete one item from 101 things list

- Total spending within budget

And now, here are those gnarly charts.

One Comment