May was one busy month! We had a lot going on, but through it all, we managed to stick fairly close to our [new] budget. We had a positive cash flow for the month, which is the goal of the new budget implemented this month. The stock market did not fare so well in May and our net worth took a tumble, losing all of the big gains we saw in April. That bums us out a little; it’s always nice when a market tailwind helps out the numbers.

What were we up to in May? We each had several work-related events and hosted lots of gatherings. During the last week of May we went on vacation to Las Vegas (trip recap coming soon!). Overall, we’re pleased with how well we contained our spending considering how social and busy we were. It is great to see that our effort to do more with less is paying off. We also continue to prove our theory that spending doesn’t directly correlate with happiness.

Here’s how we did on our May goals:

- Meet our new budget

- A I’m revising this goal to “implement monthly budget” based on how Mr. Vine operates the budget. We succeeded at not spending money where it wasn’t budgeted, and we succeeded in having a net positive cash flow for the month.

- Weekly blog posts

- A I squeaked by with this one, scheduling a few advance posts one Sunday afternoon. This pretty much depleted our backlog of drafted posts, though. So more writing is in order to maintain this goal!

- Complete two half marathon races (Ms. Vine)

- A The first race went well, the second one was much harder. But both are finished and I have new hardware to hang on my medal hook.

- Resolve credit card balances

- Incomplete When we set this goal, we didn’t realize that some of the balances we wanted to resolve would carry over into June. As always, we paid off our statement balances fully in May. But, there is one big balance that will come due in June from our spendy April, so this goal carries over for next month.

Here’s what we plan to accomplish in June:

- Implement month 2 of new budget

- Weekly blog posts

- Complete one half marathon and qualify for half fanatics (Ms. Vine)

- Complete resolution of credit card balances

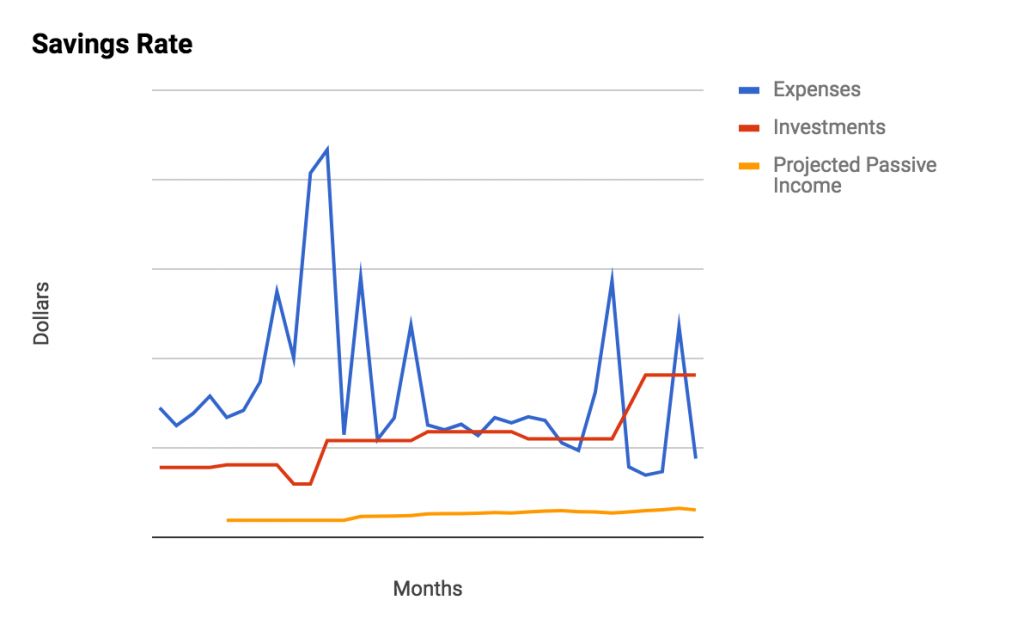

The chart looks better this month, with a sizable drop in the expenses line, as was expected. We’re feeling positive that our spending is getting much more predictable. We’re also exercising higher levels of discipline and self control. It feels good to be more intentional and to have fewer surprises at the end of the month when reconciling our accounts. Now, if only the stock market would cooperate and act a little more predictable, too!