December was a strange month. I typically write these monthly updates in pieces. Once a week or so, I’ll edit the draft with an update on what we did over the past week. Some months, we have so much going on that I choose what to include. December felt slower, but it wasn’t. It helped that my big case was mostly resolved so work felt less intense. We still worked a lot–including putting in some weekend hours and long days. December, similarly to November felt long.

This month felt uneventful for some reason, even though it was quite busy. We attended several holiday parties–for my firm, for our building. We spent a week in Florida at the end of the month. We kept up with our friends and community involvement.

Life felt organized and stable for the most part. That’s a good thing. For some frugal living fun, we implemented a no grocery challenge at the beginning of the month. We wanted to put some effort into clearing out our fridge in advance of our end of the month vacation. We find that doing this occasionally improves our creativity, prevents food waste and saves quite a bit of money. In the days leading up to our vacation, I frequently posted our meals on instagram. We avoided grocery shopping during the entire month of December until we arrived at our vacation condo on December 21. We even managed to host a couple of small dinners for friends without a grocery run.

The week before Christmas we browsed a local outlet mall. I needed to replace a watch battery and we had some credit card offers we considered redeeming. Ultimately, we found that all we needed was a button up shirt for Mr. Vine and my planned watch battery replacement. We met up with a friend and spent a few hours looking through shops. The whole experience left me reflective. It was a fairly frugal outing–we didn’t make any impulse purchases and spent less than $50. The joy of the outing was in spending time with our friend.

I ended a clothing purchase ban that lasted most of the year. I bought a couple pairs of pants suitable for work on a second-hand website. While we were on vacation, we both bought a few additional articles of clothing. Upon our return, I realized that it’s time for another closet reorganization. So that is on the schedule for this winter. We also have a couple of minor home improvement projects we want to tackle in the new year.

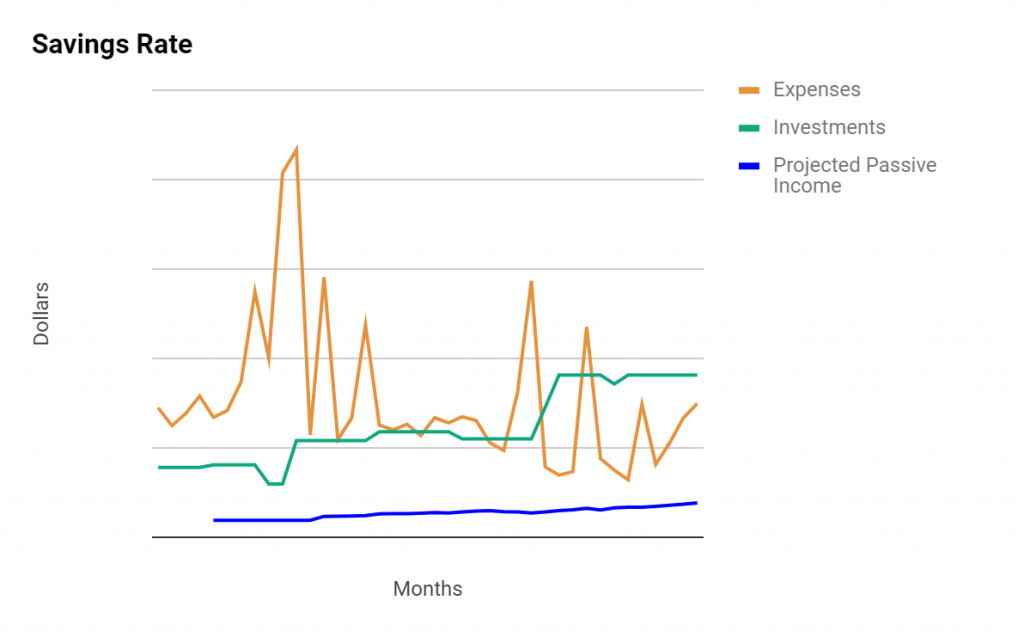

Here is a look at our savings rate chart. As you can see, December was our third highest spending month of the year. We have some big year-end expenses, like our timeshare maintenance fees that increase our December expenses. We often save some expenses like holiday gifts for each other, following year travel and home improvement items for the final month of the year. This is partially purchase procrastination, partially based on how the year has gone overall and partially due to receipt of year-end bonuses. This year we had more volatility in spending on a month to month basis than we did in 2018, but overall our spending was lower–nearly 20% lower! That’s a big reduction and we’re proud of ourselves for achieving it. Fun fact: our December 2019 total spending was fully half of what we spent in December 2018!

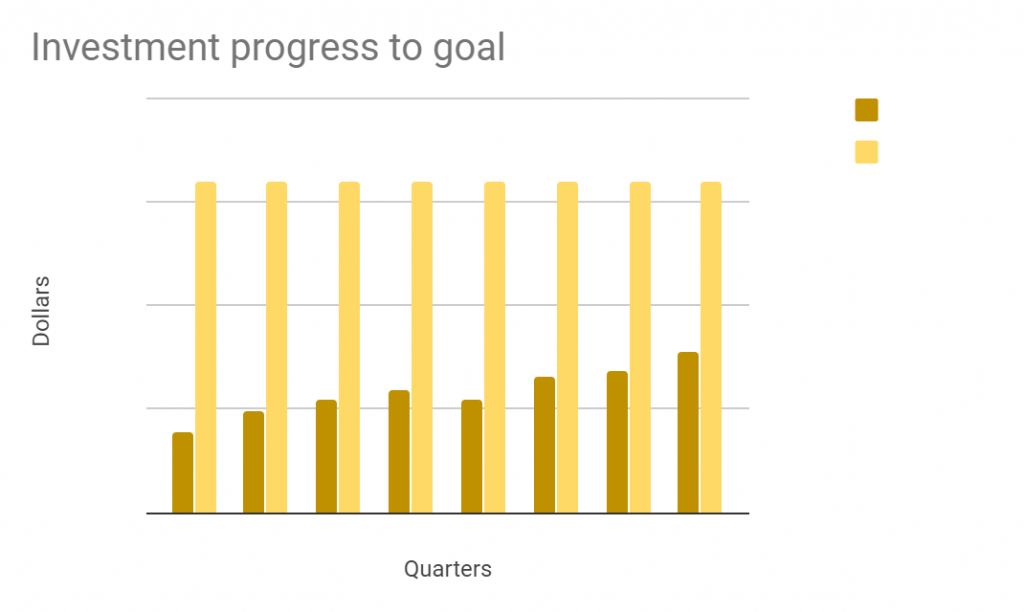

It is time for another quarterly net worth update and I really buried the lede here. Our best money news of 2019 is that we achieved a big milestone that we’ve been chasing for awhile. We hit this milestone a month earlier than our projections indicated we would (thanks, Mr. Market!). I’ve mentioned before that we started tracking our liquid net worth in August 2017, shortly after depositing proceeds from the sale of our first home. Our net worth has since DOUBLED! I don’t know if there are enough exclamation points to convey how excited I am about this milestone. We find that often the most arbitrary money milestones feel the most significant. This one isn’t tied to any other target number–it is simply a doubling of our net worth since we started tracking. It isn’t a round number, either. But this feels like a giant leap in the direction of our goals. Without further ado, here is our net worth chart.

- Stick to monthly budget

- C We went over budget on a few things in a month that’s already fairly high in terms of spending. But we showed some restraint and didn’t spend mindlessly. So I’m giving us a C.

- Weekly blog posts

- Done!

- Daily exercise

- Done! I completed a run streak from Thanksgiving to Christmas. Then I decided to extend it to New Year’s Day. In 2020, I’m going to add strength training back into my fitness routine.

- Cross one item off the 101 tasks list

- Done! I crossed off two items–present at 5 seminars and finish current journal.

January Goals:

- Complete bedroom redecoration

- Strength training 3x per week

- Schedule a physical

- Stick to monthly budget