March, like February, was another relatively uneventful month for our finances. This is good. Boring months make for a nice, steady flat graph. March was a decent month in the markets, helping to boost our net worth. Our nest egg size is getting to the point where good market months can make a big difference; where the increase in value is more than our contribution.

Our March goals were:

- Publish one blog post in addition to monthly update (this is another one I like to put on repeat)

- A — I’ve finally gotten into a solid routine for writing and scheduling posts. Soon, it might be time to replace this goal with another one. Come back for new posts every Monday!

- Continue running streak

- A — The running streak lives! I logged around 80 miles in March. The weather continued to make running difficult, but I persevered.

- Complete one item from the 101 tasks list

- This didn’t happen. I worked on several items from the list, including an attempt at 30 instragram posts in 30 days. I found that not to be very enjoyable, though. It was fun for the first two weeks.

- Start a Whole30

- C — We did start a Whole30, but we haven’t been good at it. Instead, we’ve renamed it the Whole30-ish. When our 30 days expires, I’ll write a post recapping our experience.

- Personal spending within budget

- A for Mr. Vine and B- for Ms. Vine (I went a little over). This goal needs to stay on repeat until we (I) master it. Personal money and restaurant spending are our big focus points for 2019.

Here are our April goals:

- Get on track with production target (career job goal)

- Maintain weekly blog posts

- Personal spending within budget

- Spring cleaning for our storage rooms

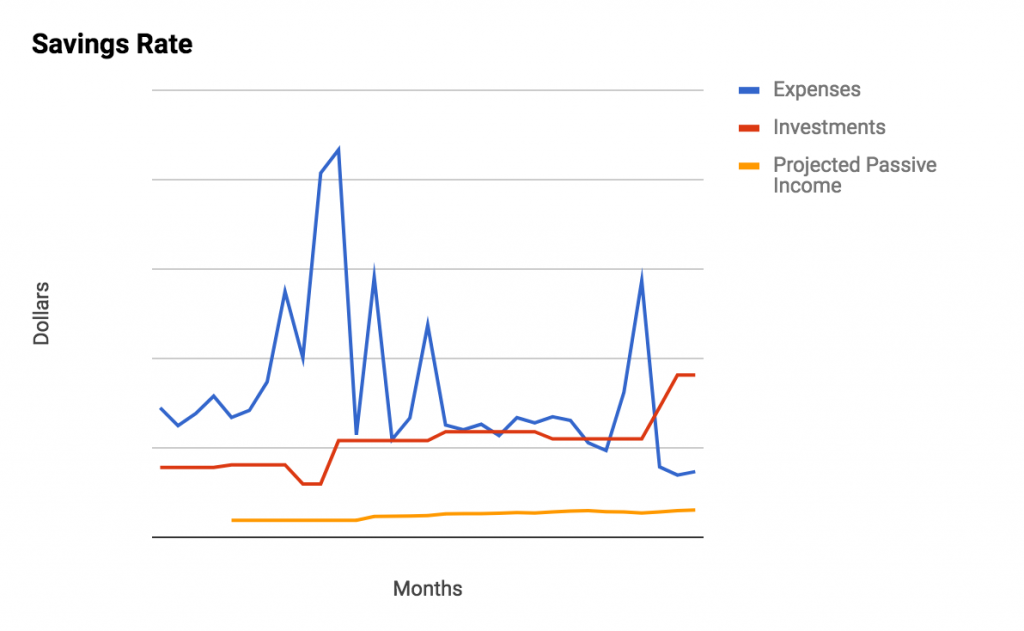

I like the way our graph is starting to shape up. We crossed a big net worth milestone late last year / early this year, but we feel very far away from the next big one. This year we are considering stepping up mortgage payments to put our condo payoff on a more aggressive schedule. Even though we said we wouldn’t do that, we’re now reconsidering. Paying off debt is an incredibly satisfying endeavor, and the mortgage is our last one to slay. Waiting for our nest egg to reach the goal often feels like watching paint dry, but paying off debt gives us a bit more of an emotional boost. Not to mention, it locks in a non-zero return and will lower our monthly expenses.