During March, we continued our stay in an Airbnb. Initially, we had planned that this stay would be one month, with our planned check out date for March 21. We weren’t comfortable with the renovation progress and decided to extend for another 28 nights, into mid-April.

Our suite was great and we enjoyed the location. The pandemic put a damper on many of the activities we ordinarily would have enjoyed–like dining out at some of our favorite restaurants. But, nonetheless, I enjoyed daily runs, past plenty of familiar spots from my time in grad school. We watched winter slowly start to give way to spring and that was refreshing. We got our first dose of the COVID vaccine in March! And nearly every in my camera roll was of the cats hanging out in the Airbnb. The mood of the month was an effort at normalcy during very abnormal times. As the year moves on, perhaps we will get to the point where we start setting monthly goals again, rather than simply trying to survive.

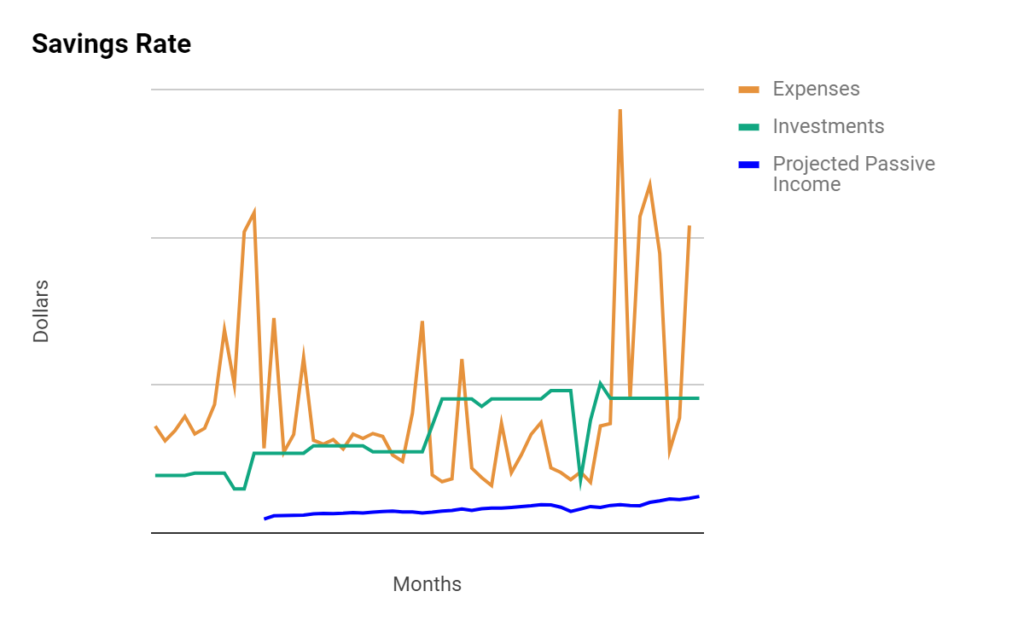

The numbers are still chaotic. March was a big month for the home renovation, as you can see from the spending spike. By the end of the month, we’d made some good progress on the renovation. The market was strong, giving our net worth a boost despite our lower investments. We are still on track for early retirement in 2024, though. It feels like that has taken a back seat while our spending swings wildly from one month to the next.

After the renovation is complete, our spending will likely remain somewhat high as we buy some items for the new house. The slow renovation has had a positive effect on our finances–it’s easier to cashflow that way. Plus, these other new home purchases have been delayed. We also want to do some hardscaping and other upgrades to yard this fall. That said, by the fourth quarter, we’re expecting more level spending and more money going to investments.