The month started with our return from a Labor Day weekend getaway. Our investments looked flat, but actually were down. September was a higher than usual spending month on account of pulling forward some of the items scheduled for October. More on that later.

Our first money win of the month was turning down an upgrade to our timeshare ownership. Timeshares are one of those areas we abandon conventional wisdom. While we were on our Labor Day weekend getaway, we listened to an upgrade pitch in exchange for some cash. Right now, we’re using the timeshare to cover lodging for as many trips as possible. This has helped advance our goal to keep travel expenses low. We’ve also traveled a bit less in 2019 because we’re focusing on our career jobs. Travel is one of our highest spend categories. In 2018, it represented 12.6% of our total spending (compared with 16% for housing). Making small adjustments in how we travel has yielded big savings.

We had another money win in how we celebrated my birthday. Mr. Vine cooked a steak dinner for a small group of friends. Then, we invited a larger group over to our patio for drinks. I made sangria and we opened some wine from our “cellar”. One of the bottles was expensive, but we’d already paid for it. Our friends were also generous in bringing over additional bottles. The day after, we took a long hike in my favorite woods followed by a cookout, complete with a campfire and s’mores. It was a frugal and perfect way to spend the weekend and welcome in my personal new year.

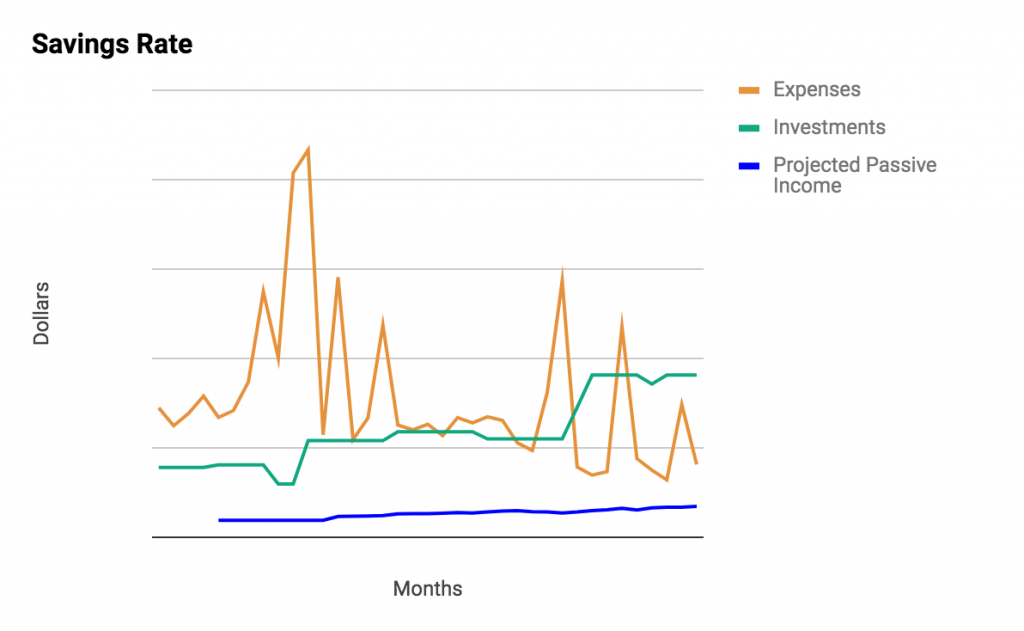

The month was busy. We attended two college football games and tailgates. Tailgates, like camping, are more difficult when you’re the organizer. We have another one planned for later in the year, too! We also attended a friend’s birthday celebration. We made an early visit to a haunted house. Many of these activities were sponsored by friends and colleagues. Our spending felt relatively under control despite the packed calendar. As you can see from the chart, it was definitely on the higher end although our categories for eating out and personal spending were normal.

Our travel spending was higher than planned. We purchased our holiday airfare a month earlier than expected because we found a great deal. We’ve been watching these fares for months and knew we wouldn’t find a better price. The unplanned travel spending came from fronting the expense for a getaway to a local amusement park. This is something we’ve thought about doing for the past few years. It’s a favorite activity for one of our friends. Although a bit of a budget buster, we feel like this is one of those experiences that’s worth it (and not something we’re going to do every year).

Here is a look at our spending vs. investing chart:

In terms of net worth, September was another volatile month in the market. We hit a new high water mark for net worth and I always love to see that. We also hit a personal net worth milestone in September. We aren’t great at coming up with ways to celebrate these waypoints. Most days already feel like a [frugal] celebration anyway. But we’d love to hear how you celebrate your financial journey milestones! Our next big one will be when our net worth doubles from when we started tracking. We expect to cross that point within the next six to twelve months (depending on how much help we get from the market).

Here how we did on our September goals:

- Reach Black level in Nike run club (Ms. Vine)

- A! I crossed into the Black level with a few miles to spare

- Weekly blog posts

- A

- Cross one item off the 101 tasks list

- F – I don’t think I even attempted this one, although I made progress on a couple of goals.

- Stick to restaurant budget

- B –So close to this one! We were over by just a bit.

October goals:

- Daily exercise

- Stick to restaurant budget

- Cross one item off the 101 tasks list

- Take at least 3 actions to increase our income